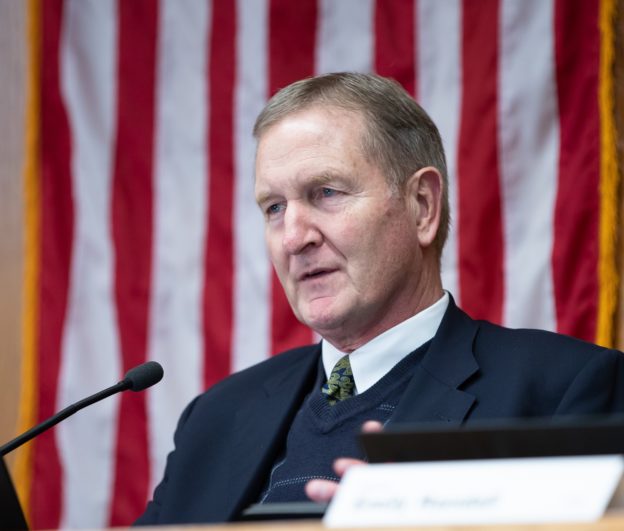

Three state senators from eastern Washington – 6th District Sen. Jeff Holy, 4th District Sen. Mike Padden and 7th District Sen. Shelly Short – are leading a legislative effort to fix a problem caused by the state Department of Revenue that affects how concrete pumpers are taxed.

Senate Bill 6317, introduced by Holy and co-sponsored by Short and Padden, would define concrete pumping services for the purposes of the retailing business and occupation and retail sales taxes. The bill received a public hearing Tuesday in the Senate Ways and Means Committee.

Concrete pumping is a construction service needed to safely move concrete to places where a concrete mixer cannot access. Without legislative or stakeholder input, DOR last October changed its guidance on Rule 211, so that contractors could no longer use a reseller permit for stand-alone concrete-pumping services but could still use it for concrete-pumping services sold with other goods or services.

“This rule change would have created an unfair disadvantage for concrete-pumping companies that do not have a primary purpose of selling other goods or services,” said Caleb Thompson with Champion Concrete Pumping, which operates across the Pacific Northwest. “As a concrete-pumping company, we would have been required to charge tax to contractors, who then also charge tax to the final buyer.”

The department’s sudden rule change last fall caused confusion and double taxation, disrupting businesses, said Holy, R-Cheney.

“It was unfair of the Department of Revenue to make a change of this magnitude that affects our concrete pumpers in such a negative way,” he said. “Fortunately, DOR was willing to delay implementing this policy change and let the Legislature address it. We now have a bill to do just that.”

Under SB 6317, “concrete pumping services” is defined as the service of delivering a concrete pump to a job site that includes an individual to control the operation of the pump and the output of concrete. The term does not include the sale of tangible personal property, including concrete. Holy, Padden and Short testified in favor of the bill during its public hearing.

“What the Department of Revenue wanted to do was a huge problem for the concrete pumpers, and that impacted everyone else,” said Padden, R-Spokane Valley. “For example, it would have added $50,000 to the cost of the Amazon project in Spokane for the cost of the concrete alone. This bill addresses what would be a serious problem for concrete pumpers and many others.”

“What the Department of Revenue was going to do amounts to double taxation, which is outrageous,” said Short, R-Addy. “It was very clear that DOR did not seek external input, resulting in unfair treatment and burdensome costs on the construction industry. This bill would ensure our concrete pumpers are taxed fairly.”

Padden, Short and Senate Republican Leader Mark Schoesler, R-Ritzville, along with Reps. Tom Dent, R-Moses Lake, Brian Blake, D-Aberdeen and Mike Chapman, D-Port Angeles, worked with the building industry to voice opposition to both the guidance change and the process used to make the change.

In a letter to DOR Director Vikki Smith, the lawmakers wrote last fall, “With the stroke of a pen, DOR has managed to create chaos, disadvantage hard-working, small businesses who provide needed services in the construction industry and sanction double-taxation. …It is incredibly troublesome that DOR chose to change long-standing policy in such a secretive, non-inclusive manner.”

That same week, Smith responded to the lawmakers, announcing the delay in implementation. She wrote, “We want to be transparent on our reading of the law and delaying the interim guidance’s effective date accomplishes this objective while affording the Legislature time to make changes and for stakeholders to provide additional feedback.”

Lawmakers applauded the move, calling it an example of how government should be responsive to the needs of the community.